Download Our Drug Trends Infographic Now

2020 was in many ways the “year of the essential worker.” The vast changes brought upon the workforce, including many states enacting stay-at-home orders, resulted in a universal drop in new claims. The dramatic shift in claim age mix presents challenges to analyzing trends year-over-year as newer claims have a significantly different profile than older claims. On average, older claims represent higher utilization and cost. To provide the most accurate view of continued trends in pharmacy program management, we focused our data analysis on claims aged 2 years or greater for comparison with the previous year. In our drug trends series, we will reflect on the trends our clients experienced in 2020, providing an overall picture of both in- and out-of-network. Although 2020 proved to be a year of immense change, Mitchell Pharmacy Solutions continued to help our clients successfully manage their pharmacy programs. The first segment of our drug trends series delves into retail and mail-order trends for in-network prescriptions billed through our pharmacy benefit management (PBM) solution in 2019 and 2020. Download the infographic or continue through the article below to see how trends shifted through 2020.

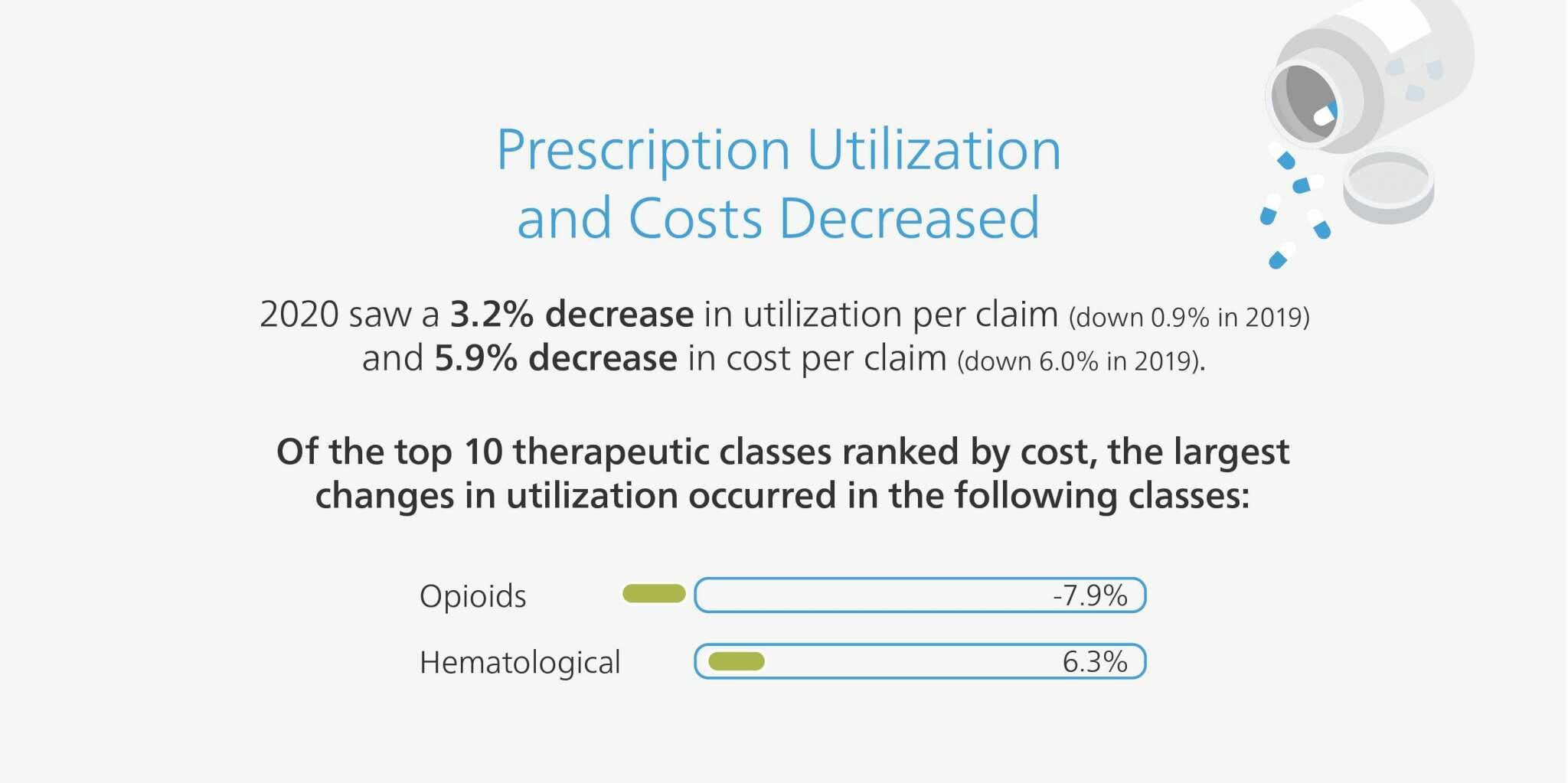

Prescription Utilization and Costs Decreased

Following several years of declining trends, 2020 followed a similar pattern with a 3.2% decrease in utilization per claim and a 5.9% decrease in cost per claim. Of the top therapeutic classes, ranked by cost, the largest changes occurred among opioids and hematological drugs.

Medications for Mental Health

As mental health became a vital topic of discussion for those recovering from injuries while dealing with a pandemic and its consequences, we saw an increase in antidepressants, antipsychotics and psychotherapeutics in NEW claims. The older claims population, interestingly, saw a decrease in these types of medications. This trend seems to underline the importance of managing mental health in new claimants, especially during a time of immense stress and uncertainty. Mental health continues to be an important factor in helping injured workers return to work – read more about how to manage mental health conditions with your claimants.

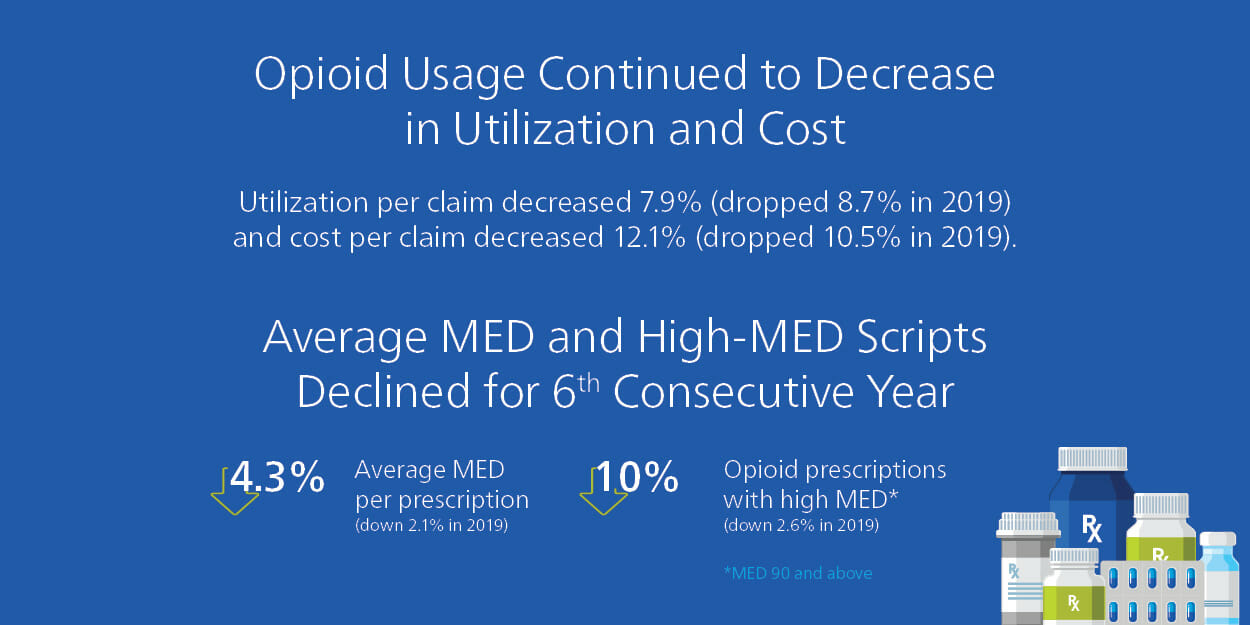

Opioid Usage Continued to Decrease in Utilization and Cost

Prescription opioid usage has dropped dramatically in recent years, despite a continued rise in illicit opioid use. In 2020, opioid utilization decreased 7.9% and cost per claim of opioids decreased 12.0%. Average MED and high-MED scripts also continued to decline. Read more about strategies to reduce high-MED claims using a personalized approach.

Average Wholesale Price in Older Claims

Overall, AWP increased 1.1%, with the largest increase occurring in brand name products. As a note, the manufacturers set the AWP price for a drug. The largest difference in AWP within the top five therapeutic classes was reflected in the sustained-release opioid class, which saw a 4.6% increase in AWP overall (5.8% increase in brand AWP and 2.1% increase in generic AWP).

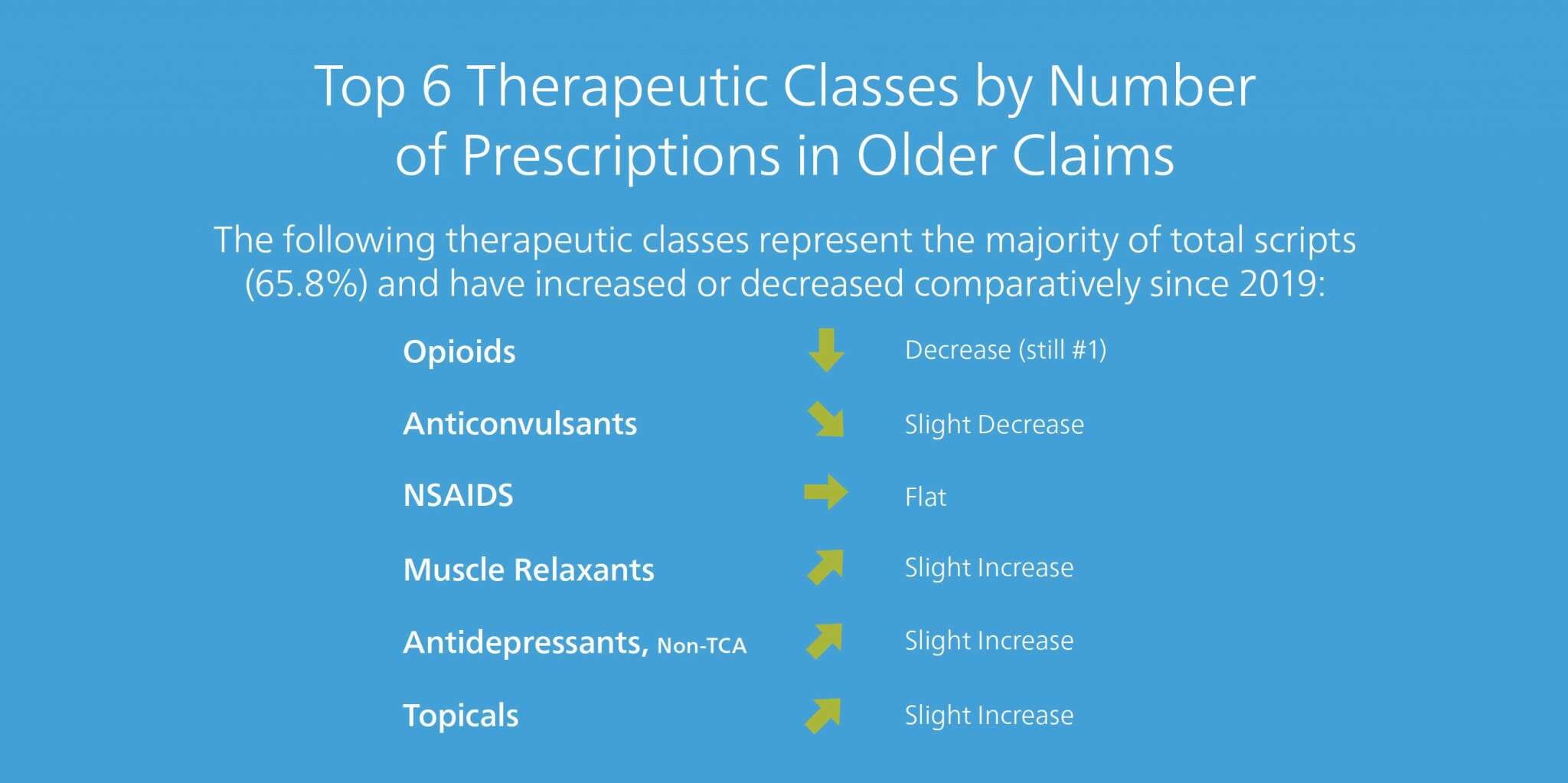

Top Therapeutic Classes by Number of Prescriptions

The following chart represents the top therapeutic classes by number of prescriptions and their change in volume relative to the other classes in the group, listed by rank in total scripts. These top six classes represent 65.8% of total scripts and are consistent with 2019 rankings. Opioids, anticonvulsants and antidepressants are used more frequently for injuries two years and beyond. Even though opioids continue to decrease in volume, they are still the number one category of prescription drugs.