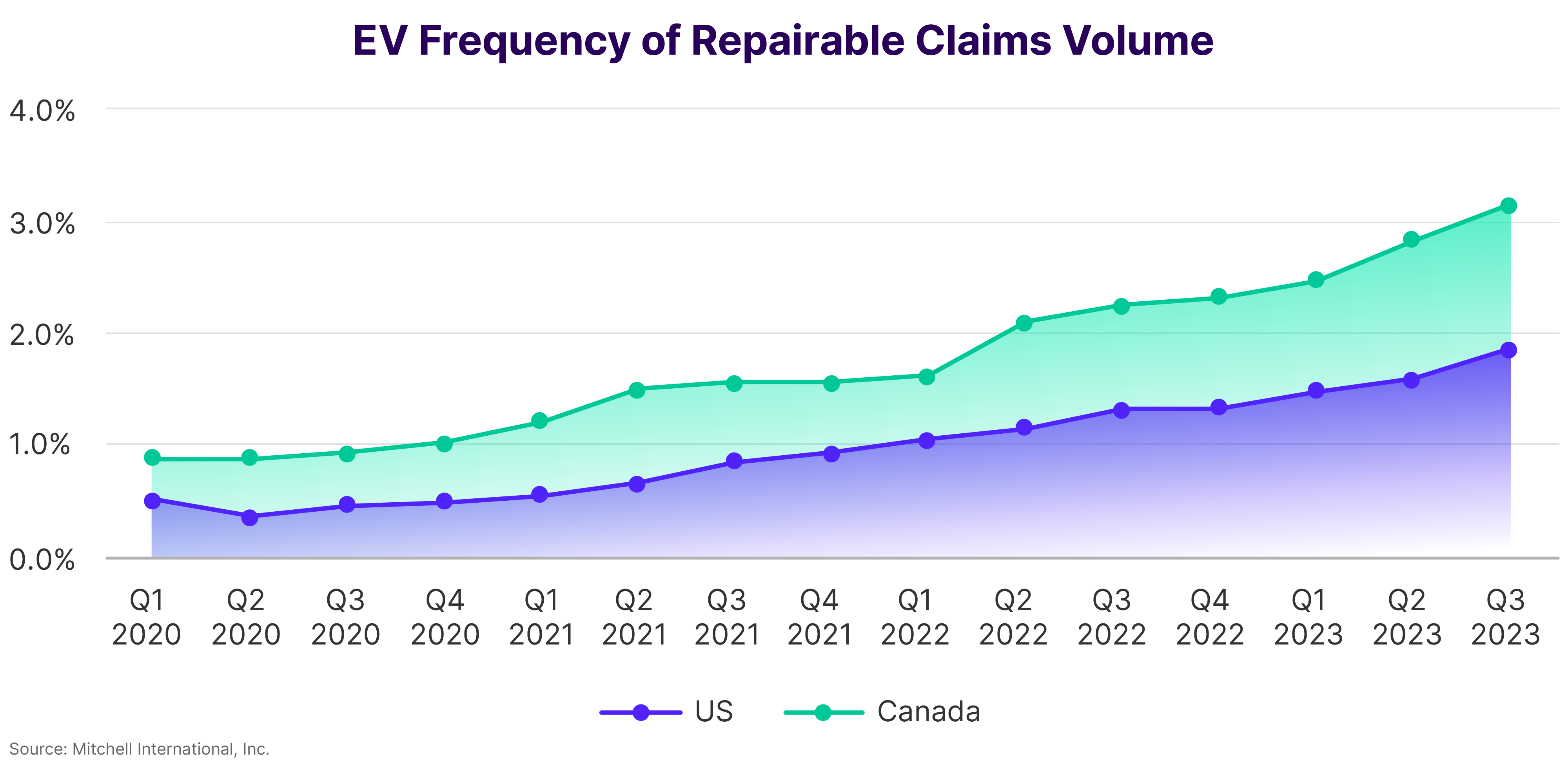

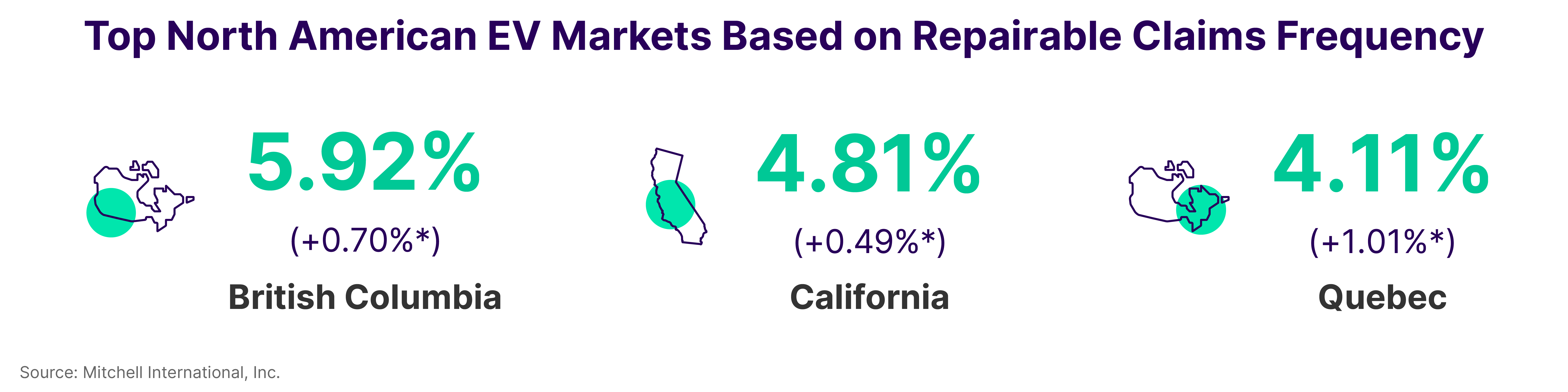

Electric vehicle (EV) repairable claims frequency rose to 1.86% in the U.S. and 3.14% in Canada in Q3 2023—up a modest 0.37% and 0.50% respectively from Q2. Tesla, the world’s largest EV manufacturer, accounted for over 70% of the EVs repaired in North American collision facilities last quarter. Signaling potential changes to the EV repair mix of the future, Cox Automotive reported a decrease in Tesla’s share of new U.S. EV sales in Q3, despite a record-setting 300,000 EVs sold (a 49.8% increase from the same time period in 2022). In addition, 14 EV models not available a year ago—including the Chevy Blazer and Silverado—are now on U.S. roads. In Canada, S&P Global noted that Tesla’s share of new registrations for Zero Emission Vehicles (ZEVs)—which include battery electric and plug-in hybrid models—declined in the provinces of British Columbia, Ontario and Quebec in the past 18 months. Canada also saw the first Rivian vehicles (both the R1T and R1S) in auto body shops along with the first Genesis Electrified GV70 luxury sport utility vehicle (SUV) and an increasing number of F-150 Lightning all-electric trucks and Mustang Mach-E SUVs.

One common misperception about EVs is that insurers write them off as a total loss more frequently—and even with only minor damage—than vehicles with an internal combustion engine (ICE). Although the damage to an EV’s lithium-ion battery significantly increases the likelihood of a total loss outcome, current claims data demonstrates a comparatively low total loss rate for electrified automobiles. For example, when evaluating Q1-Q3 2023 claims for 2020 and newer vehicles, the EV total loss rate was 7.25%. Luxury ICE automobiles (which have a comparable actual cash value, ACV, to EVs), however, had a total loss rate of 7.47% and the rate increased to 8.49% for all ICE vehicle models. This data obviously contradicts the notion that EVs are more likely to be designated a total loss than their ICE counterparts of a similar model year and ACV.

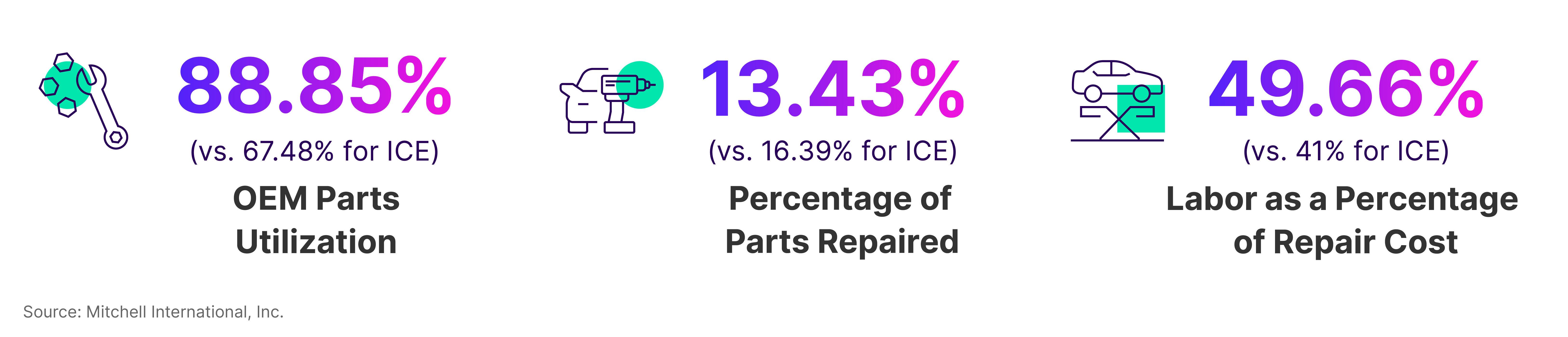

Differences between the two propulsion types do surface, though, when examining parts and labor trends. In Q3 2023, EV repairs trended heavier in terms of labor with 49.66% of the total repair cost devoted to labor compared to 41% for ICE vehicles. On average, this equates to more than six additional labor hours per repair. A significant portion of this labor hour delta relates to the management of the high-voltage battery with operations required for de-energizing the system and, frequently, for the battery’s complete removal during repair when called for by the manufacturer.

“Q1-Q3 claims for 2020 and newer vehicles showed an EV total loss rate of 7.25% compared to 7.47% for luxury ICE automobiles and 8.49% for all ICE vehicle models.”

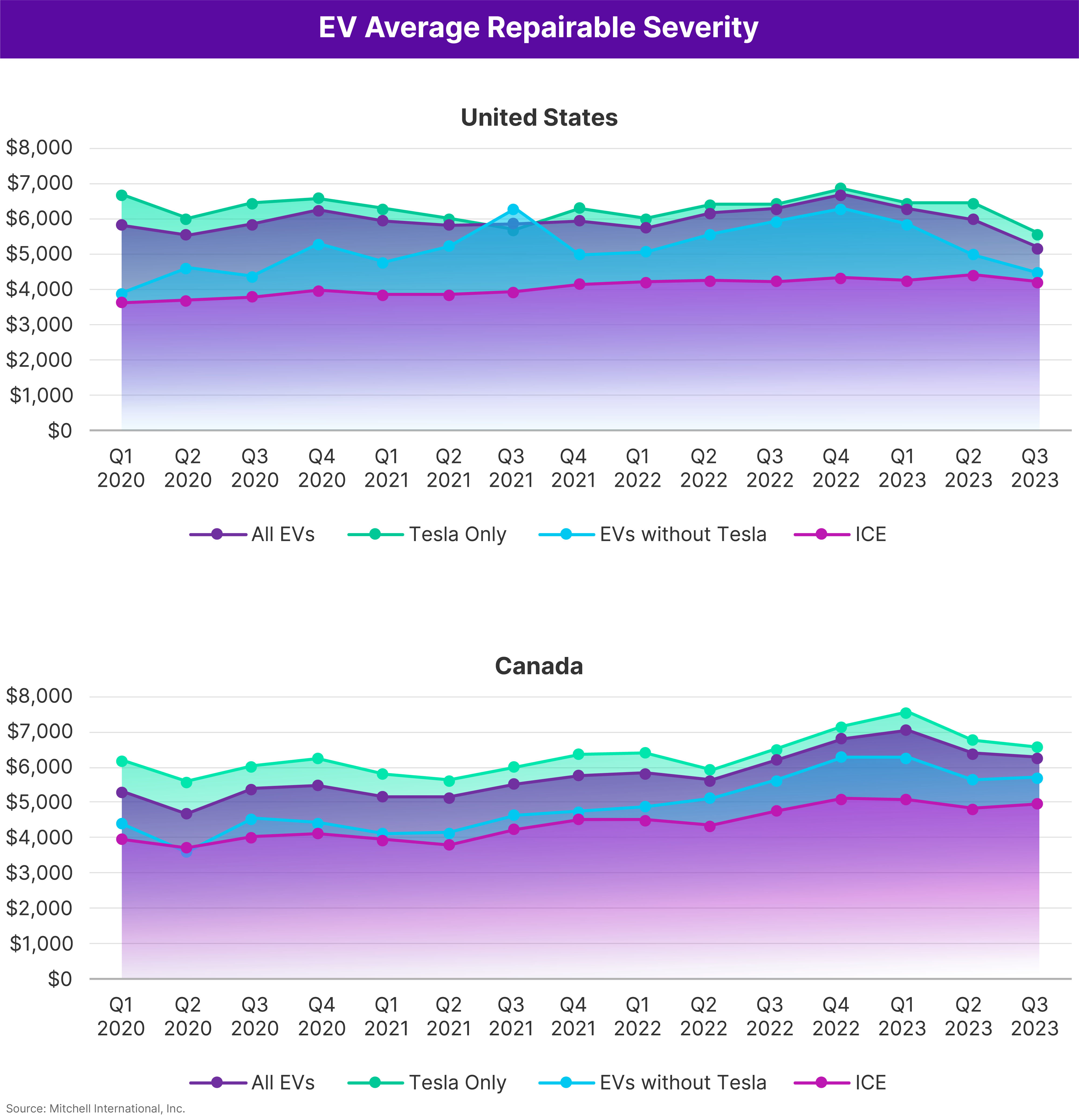

Overall, Q3 repair costs for all EVs continued to trend higher than those for ICE automobiles, with a cost differential of $950 in the U.S. and $1,301 in Canada. When removing Tesla models from the EV mix, the difference was $269 in the U.S. and $750 in Canada. That said, the repair cost differential between propulsion types is expected to grow over the next several months as supplements are written and entered.

To encourage greater consumer adoption, the U.S. government recently announced changes to existing tax rebate legislation that will allow buyers to take advantage of a near-instant $7,500 tax credit for new EV purchases ($4,000 for qualified used EV purchases) as a point-of-sale rebate rather than waiting to file their federal income tax return to receive the benefit. For the first nine months of this year, EVs accounted for 7.5% of new vehicle purchases in the U.S., a more than 50% increase over the same period in 2022 (Canadian sales data was not available at the time of this publication). The evolution of this tax credit—coupled with more aggressive pricing programs from automakers like Tesla to ensure their vehicles qualify for it—may lead to even higher EV sales numbers in the year ahead. Alternatively, there could be a short-term dip in Q4 as some consumers may choose to wait to take advantage of the rebate.

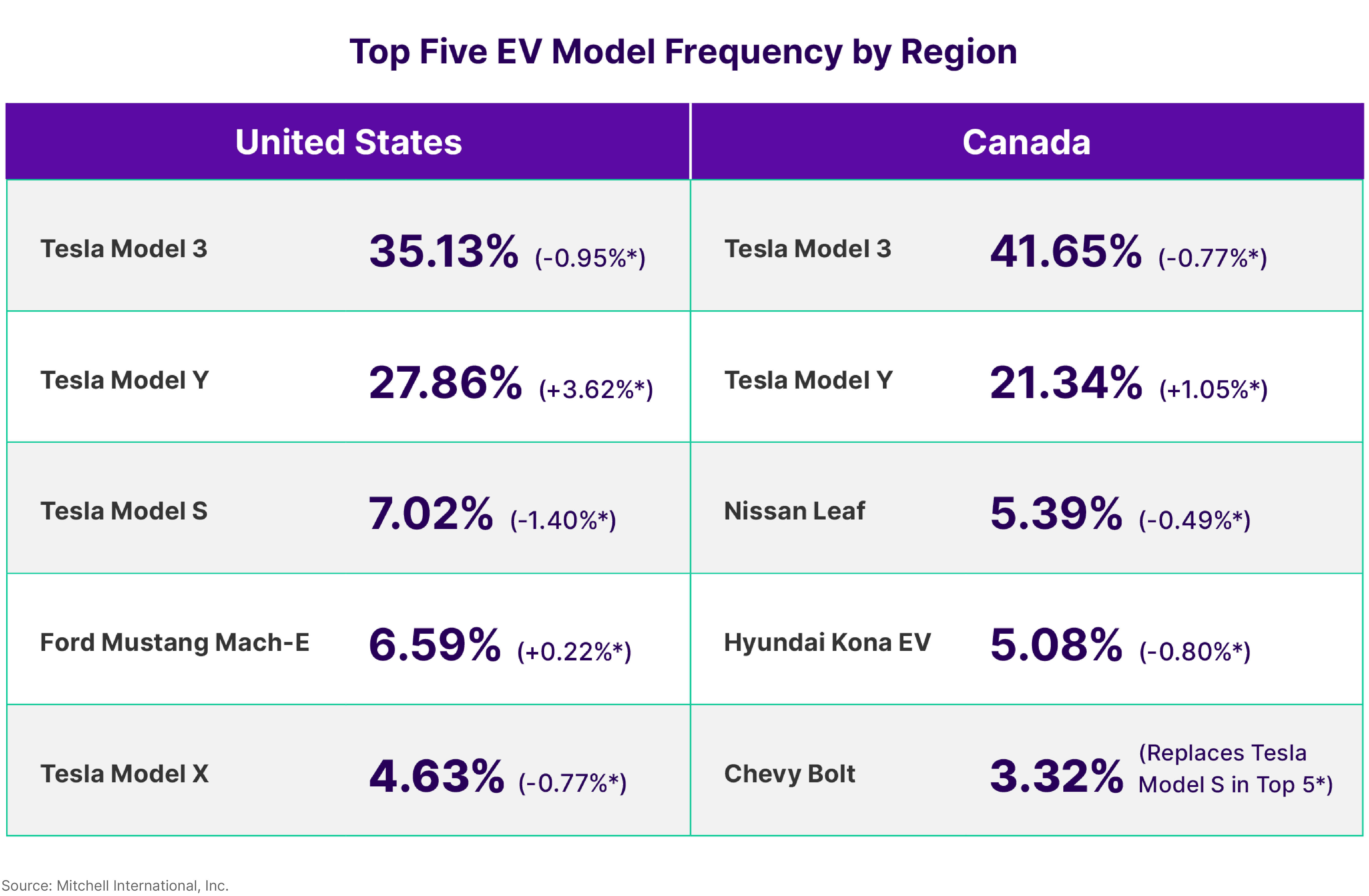

By the Numbers

*Difference between Q3 2023 and Q2 2023.

Subscribe Now

To subscribe to future issues of Mitchell's Plugged-In: EV Collision Insights report, please complete the form below.