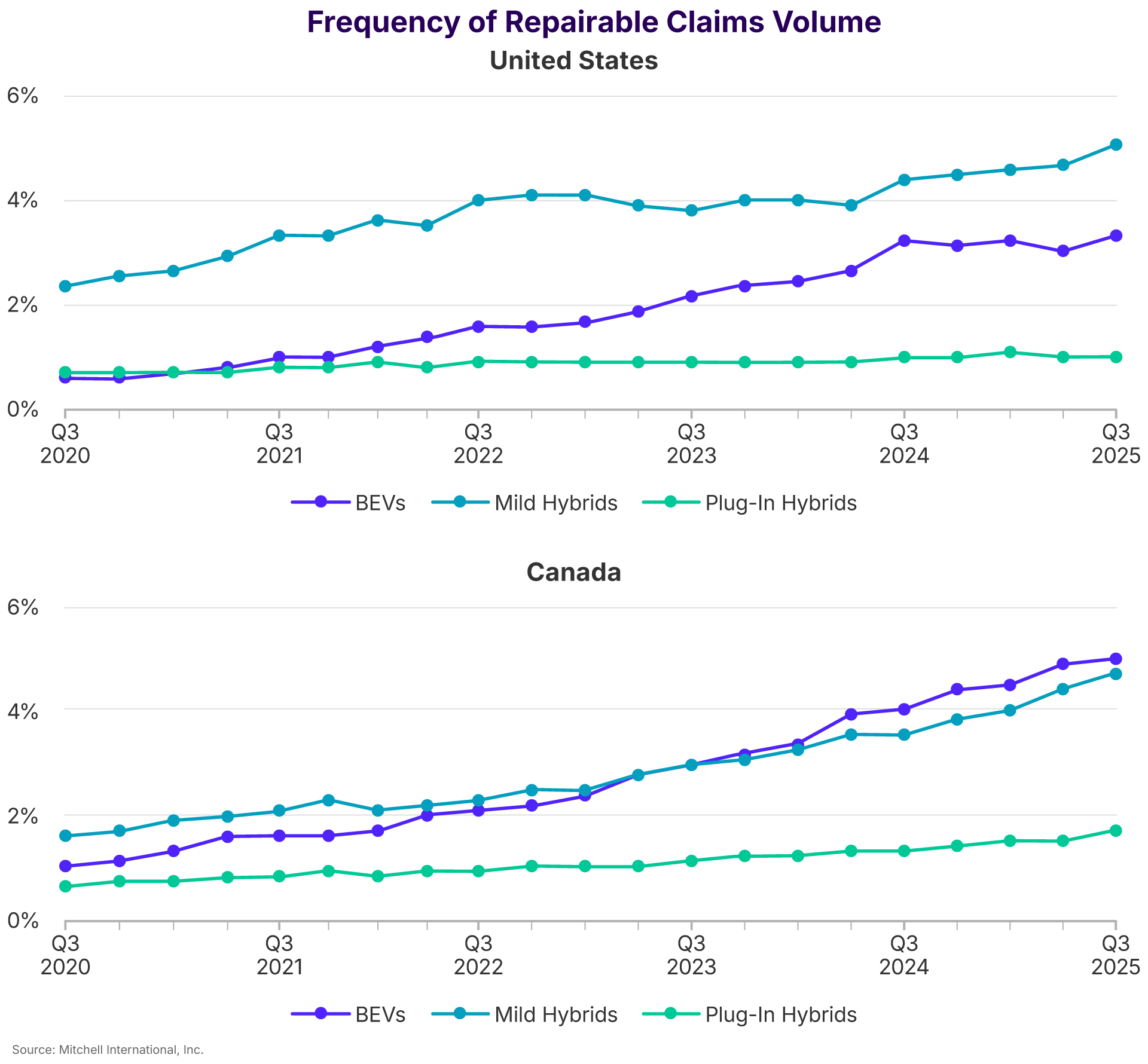

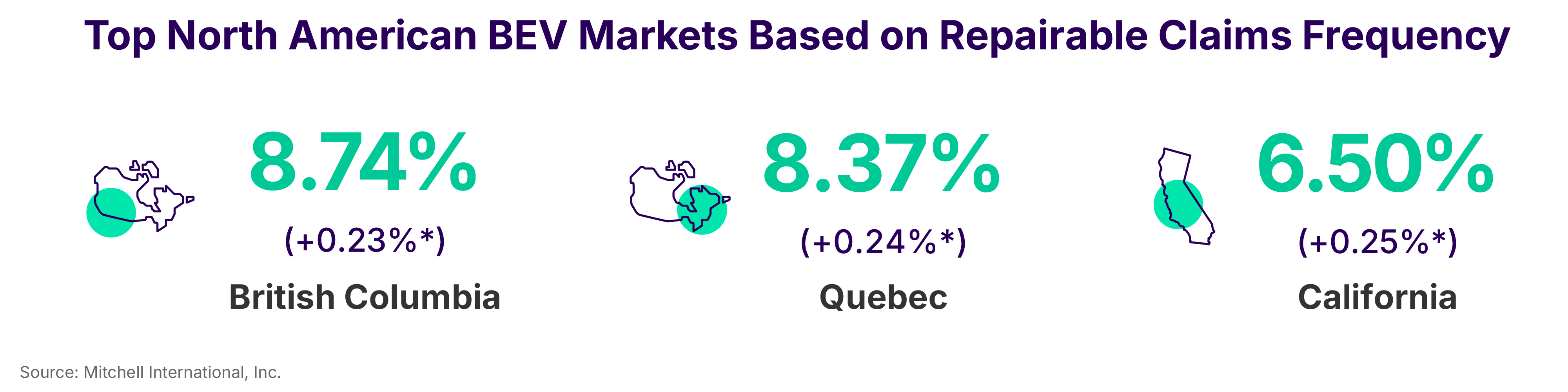

Claims frequency for repairable, collision-damaged battery electric vehicles (BEVs) rose to 3.21% in the U.S.—an all-time high and increase of 4.2% year over year. Predictably, new BEV purchases surged, jumping 36% compared to Q3 2024 as many American consumers capitalized on the $7,500 tax credit that expired on September 30. Several large automakers including GM, Ford, Kia and Hyundai reported record-breaking BEV sales in Q3 with Hyundai posting a 153% annual increase in September BEV purchases. However, Ford CEO Jim Farley cautioned that the exuberance around BEV sales could be short lived with the lack of federal tax incentives likely driving the BEV share of new vehicle purchases to the single digits, a significant decline from the high of 10-12% over the last two years.

In Canada, BEVs represented 4.91% of repairable collision claims, an annual increase of 24.3%. Although full Canadian sales data is still outstanding, early results from the third quarter appear mixed. GM reported that Cadillac BEV sales increased by 91% compared to Q2 2025, but it is important to note that several Cadillac models—including the Escalade IQ—were new to the market at this time last year. BMW reported an overall year-over-year sales decrease in the third quarter, yet signaled that M version sales of the BMW i4, i5, i7 and iX grew.

Even as BEV adoption expands with the addition of more affordable models, growth remains uneven across different regions and buyer groups. Automakers are balancing heavier investments in BEV platforms with renewed attention to hybrids and ICE variants to protect volume and margins during an uncertain transition—all while battery costs decline and incremental range improvements keep BEVs increasingly competitive.

The shift to more diversified portfolios through regional supply chains and modular manufacturing gives OEMs the ability to flex between BEVs, plug-in hybrid electric vehicles (PHEVs) and mild hybrid electric vehicles (MHEVs) based on market demand. In North America, government incentives and regulatory mandates have accelerated BEV investment and increased consumer adoption. However, recent political and trade developments are introducing uncertainty—prompting the reassessment of BEV policies, growth targets and infrastructure funding.

Businesses in the automotive ecosystem now face a gradual, geographically uneven transition to widespread vehicle electrification with variable changes in demand for charging and battery services as well as the need to adapt operations, parts sourcing strategies and workforce skills to support a wider mix of drivetrains. The wild card for the electric vehicle industry will be how rapidly new battery chemistries are brought to market that offer dramatically improved range and greater stability.

According to Electrek, Toyota plans to launch the “world’s first” all-solid-state batteries for electric vehicles by 2028. The leading automaker partnered with Sumitomo Metal Mining Co. to mass produce cathode materials for these batteries, which promise longer driving range, faster charging times and higher output compared to current liquid-based alternatives. The companies have been developing this technology since 2021 and claim to have created a “highly durable cathode material.”

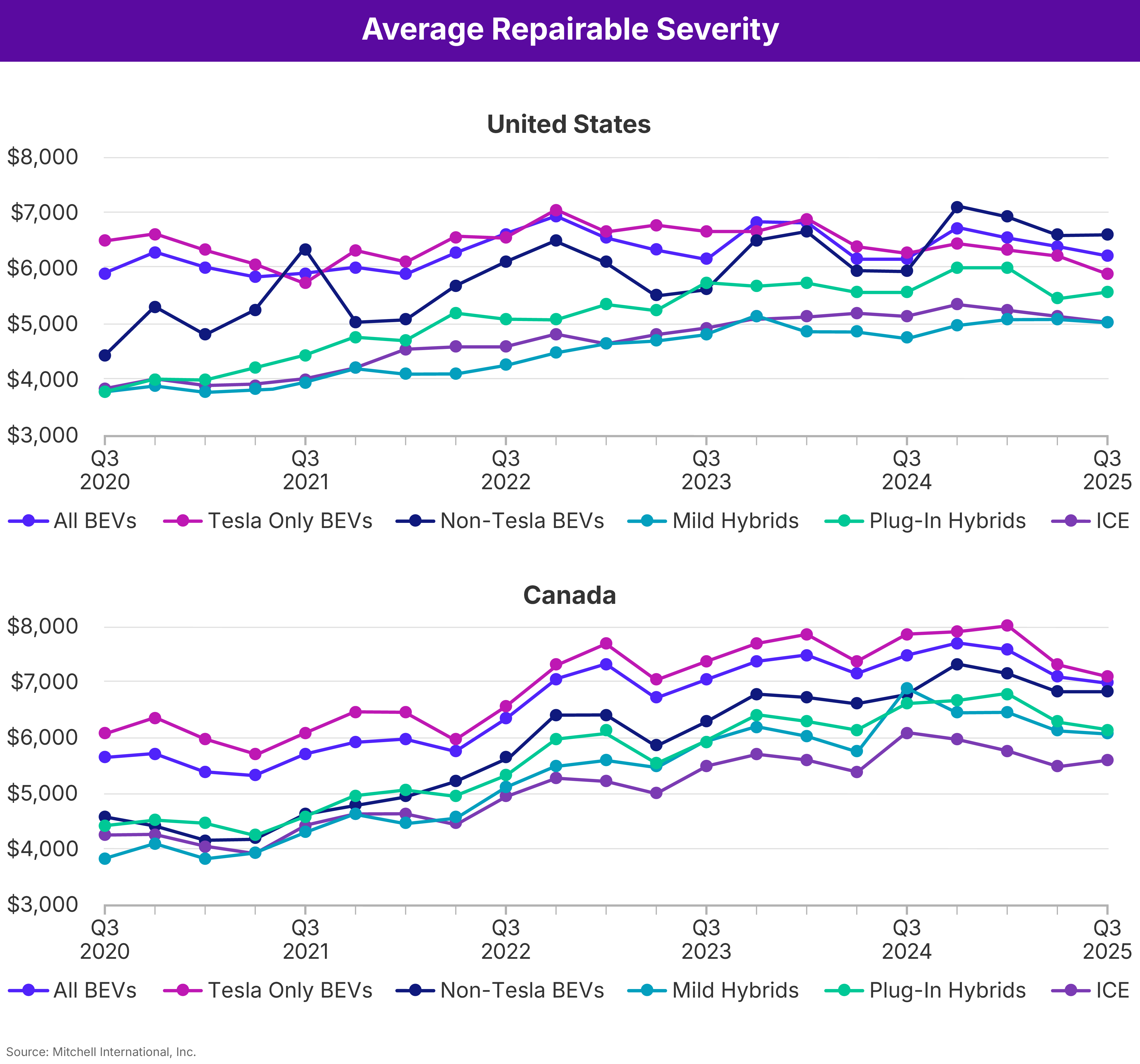

When it comes to claim costs for repairable vehicles, BEVs continue to have the highest severity due to their complexity combined with a limited aftermarket parts supply chain. In Q3, average severity for BEVs was $6,185 in the U.S. and $6,954 (CAD) in Canada—a decrease of 2.4% and 1.5% respectively from last quarter. PHEVs came in a close second in the U.S. at $5,529 followed by MHEVs at $4,983 and automobiles with an internal combustion engine (ICE) at $4,974. Similarly, in Canada average severity was $6,111 (CAD) for PHEVs, $6,064 (CAD) for MHEVs and $5,564 (CAD) for ICE alternatives.

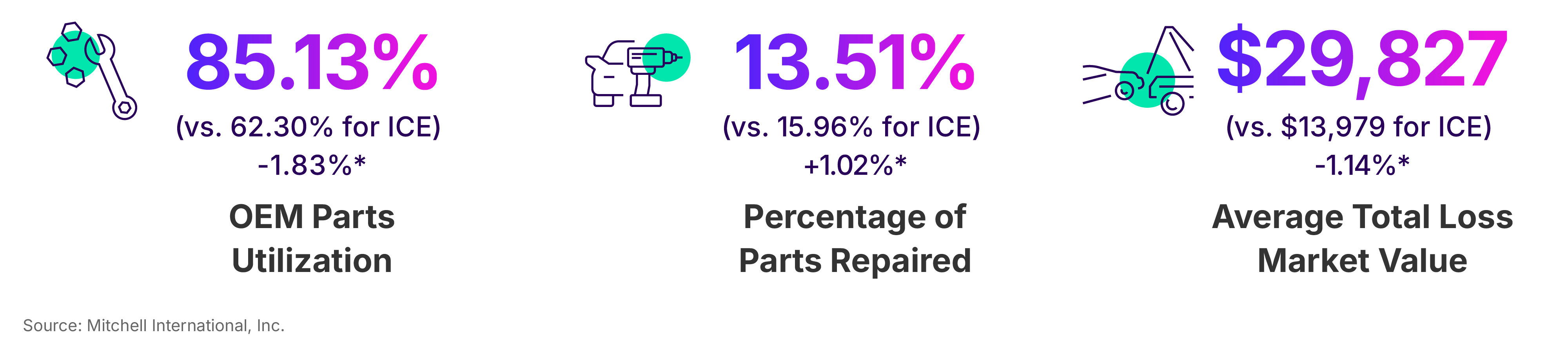

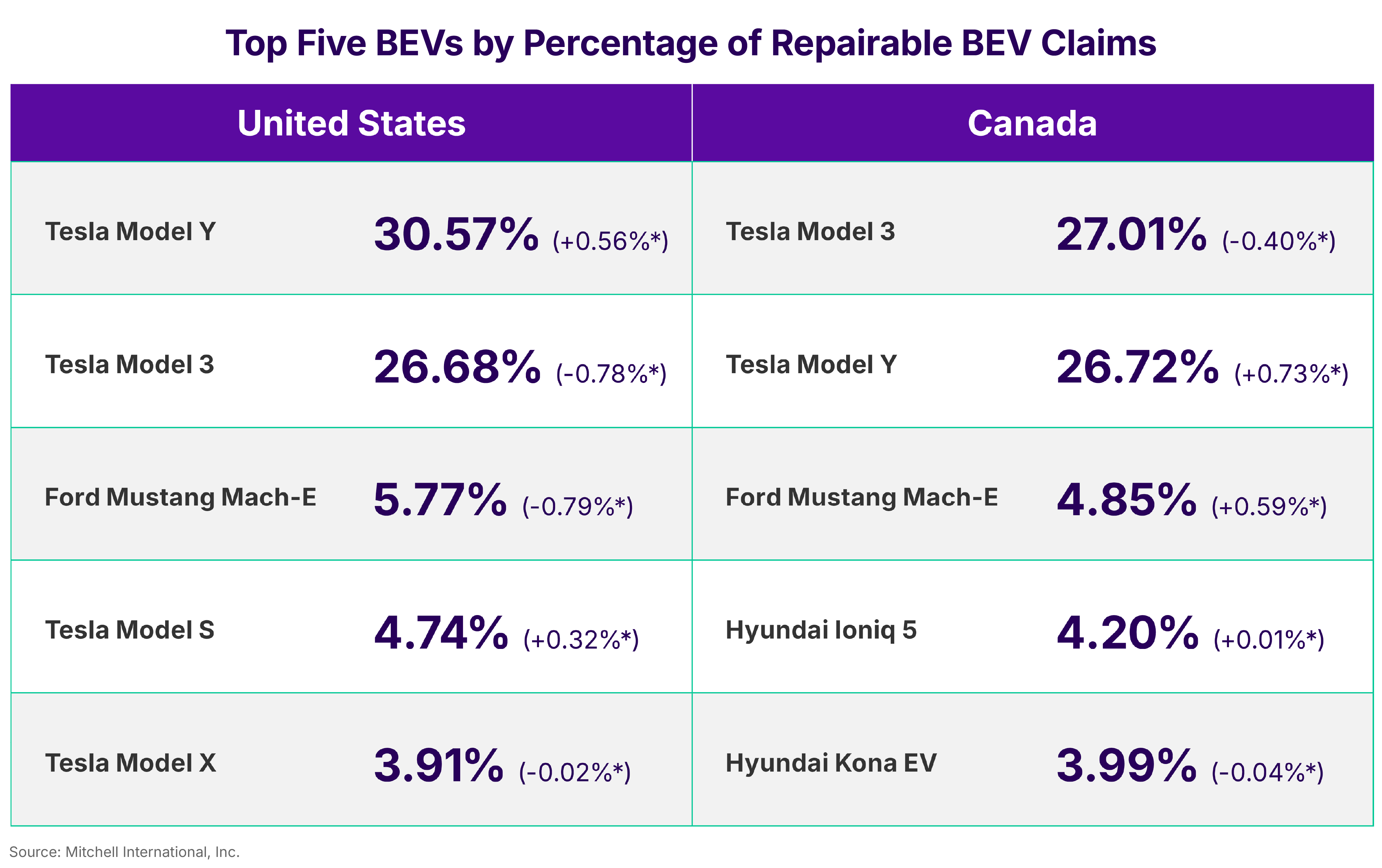

By the Numbers

*Difference between Q3 2025 and Q2 2025.

Subscribe Now

To subscribe to future issues of Mitchell's Plugged-In: EV Collision Insights report, please complete the form below.