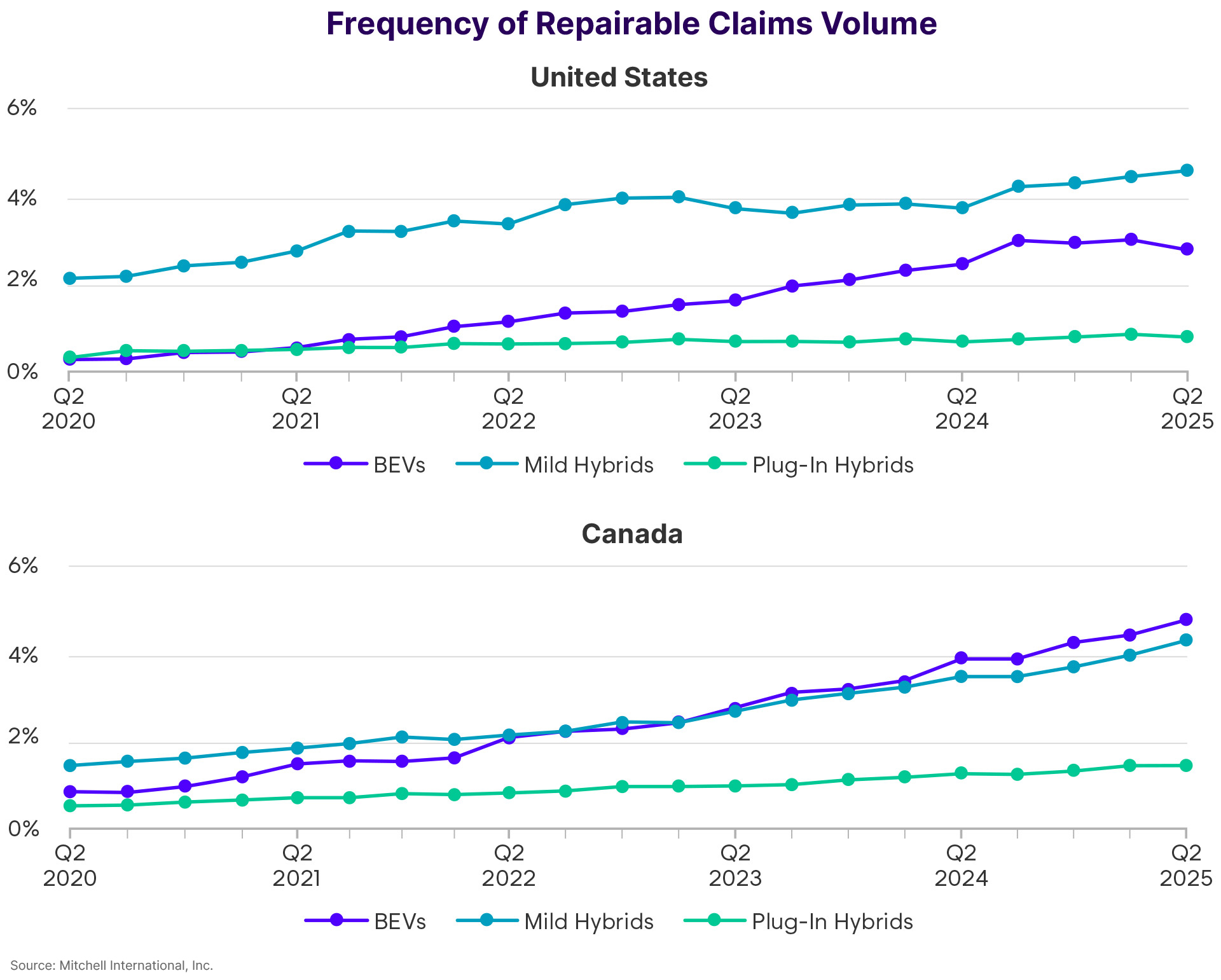

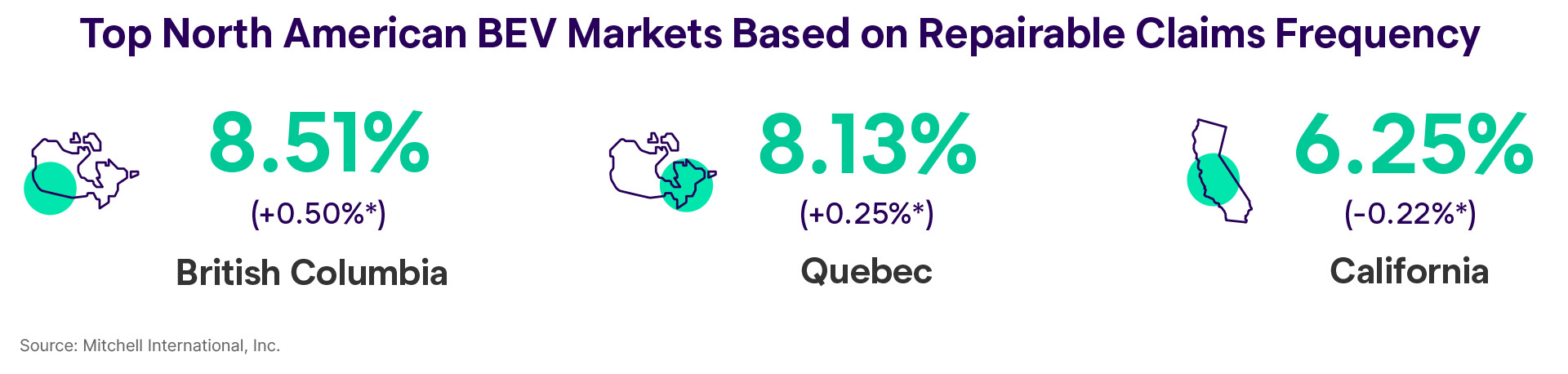

Claims frequency for repairable, collision-damaged battery electric vehicles (BEVs) fell for the first time in the U.S.—dropping to 2.92% last quarter, a decrease of 7%. This decline coincided with a 6.3% reduction in new BEV purchases compared to Q2 2024 despite record-breaking sales earlier in the year. Consumer demand is being tested as federal tax incentives are set to expire in September while discounts for electrified options reached an all-time high of nearly $8,500 per automobile by the end of the quarter. In addition, General Motors—the largest U.S. automaker—emerged as one of the strongest challengers to Tesla, doubling its BEV sales and giving buyers more alternatives.

In Canada, the frequency of repairable BEV claims continues to rise and reached 4.83% in Q2 2025, a quarterly increase of 8%. However, like the U.S., changes to government-sponsored incentive programs are threatening vehicle sales. According to J.D. Power, 42% of potential BEV buyers said they would be less likely to shop for an electric automobile without the incentives. In Quebec, where provincial BEV rebates were temporarily suspended, consumer interest declined 8%. This may contribute to slightly softer national sales in Q2 versus recent quarters. Traditional automakers including Hyundai, Kia, Toyota, Ford and Chevrolet are positioned to capture most of the remaining BEV market share in Canada as Tesla has plummeted 16% to eighth place among likely shoppers.

Even with the market headwinds, there are more BEVs on the road today than ever before and many organizations are still betting on the long-term growth of electric propulsion. For example, Panasonic recently opened a $4 billion lithium-ion battery plant in De Soto, Kansas and plans to employ 4,000 workers by the end of 2026. The company also began mass production of 2170 cells at a second North American facility with the goal of establishing annual production capacity of nearly 32 GWh in the future.

Unlike their all-electric counterparts, sales of mild hybrids are increasing. So too is claims frequency for repairable mild hybrids, which rely on a small electric motor to assist the gasoline engine. In Q2 2025, it rose to 4.62% in the U.S. and 4.33% in Canada, a jump of 2% and 9% respectively over the previous quarter. For collision repairers and auto insurers, this steady growth represents an opportunity to focus on vehicles that combine cost advantages like automobiles with an internal combustion engine (ICE) and less specialized training than is necessary for BEVs. Without the dramatic policy fluctuations affecting all-electric options, mild hybrids also present a more predictable and financially stable segment for carrier underwriting models.

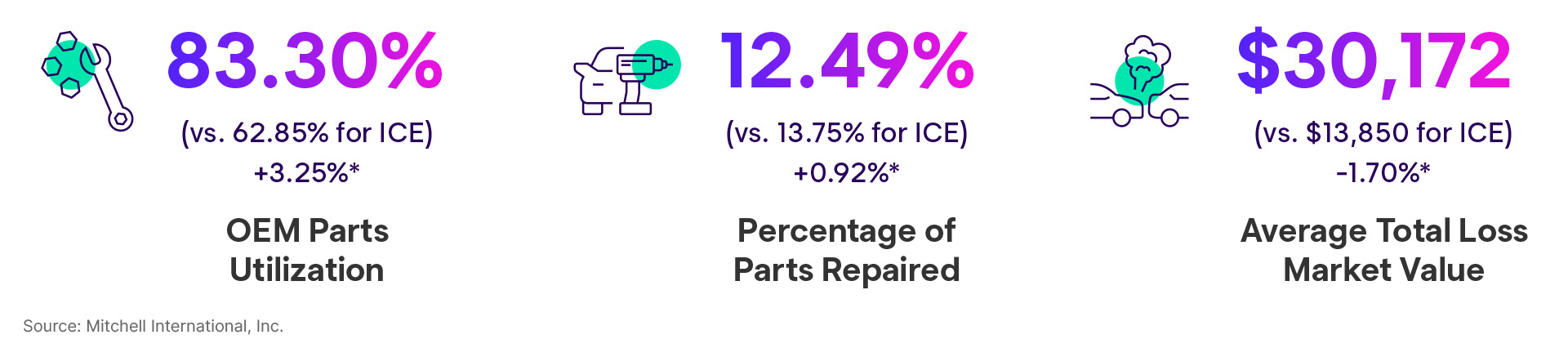

To date, tariffs and the global trade war have not substantially impacted used vehicle pricing. Total loss market values were relatively stable last quarter and BEVs continued their trend of gradual decline (-1.70%) while ICE automobiles saw a reduction in the normal range of 0.21%. Plug-in hybrid vehicle market values were similar to BEVs, declining 2.87%, while mild hybrids saw an increase in value of 1.62%. This is likely because these automobiles have not experienced the same aggressive dealer pricing tactics as their BEV and plug-in hybrid counterparts and, therefore, prices have remained stronger with more consistent demand.

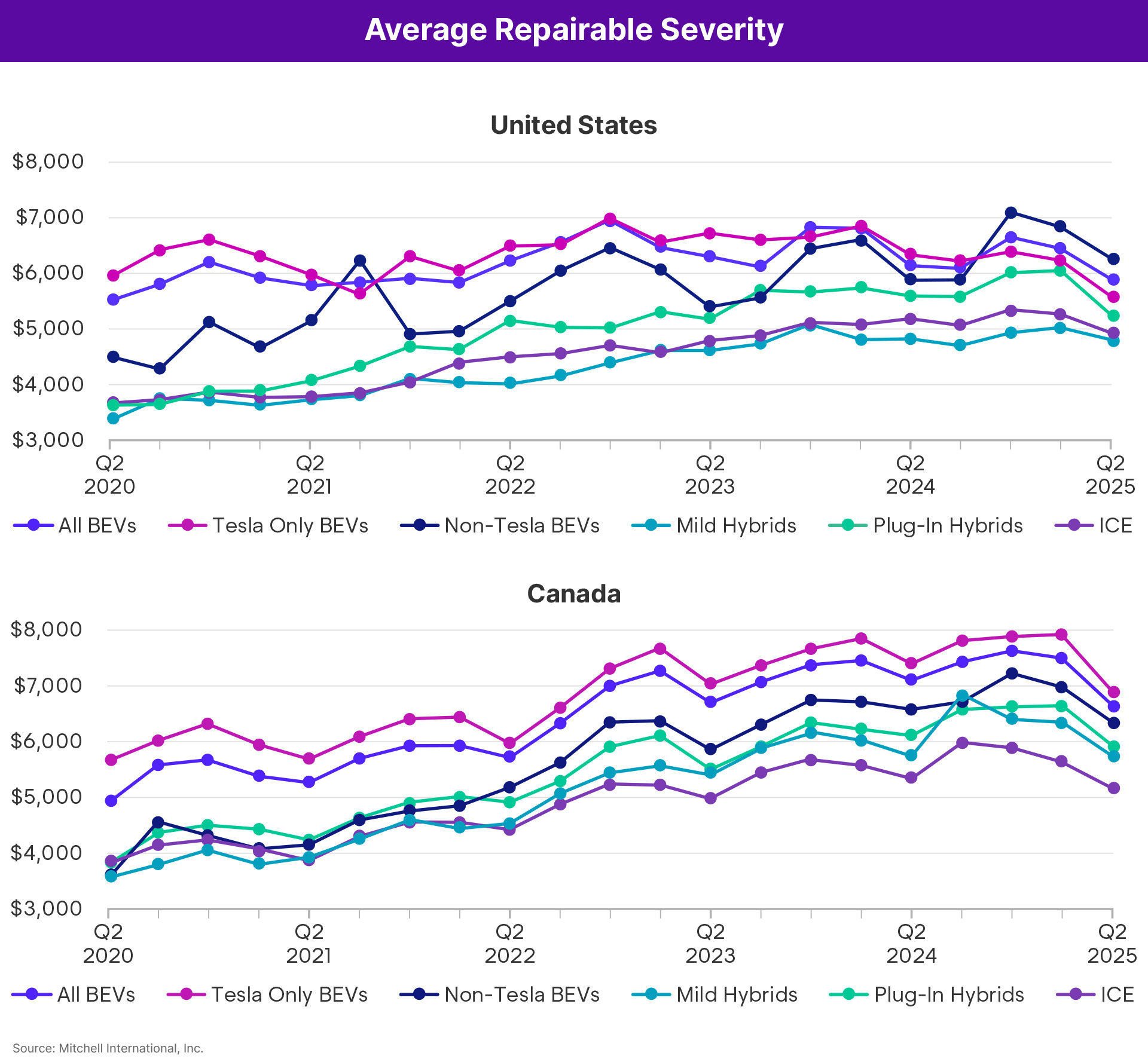

In the U.S., average severity for repairable vehicles was $5,903 for BEVs, $5,254 for plug-in hybrids, $4,788 for mild hybrids and $4,938 for ICE automobiles in Q2. In Canada, it was $6,633 (CAD) for BEVs, $5,916 (CAD) for plug-in hybrids, $5,742 (CAD) for mild hybrids and $5,156 (CAD) for ICE vehicles.

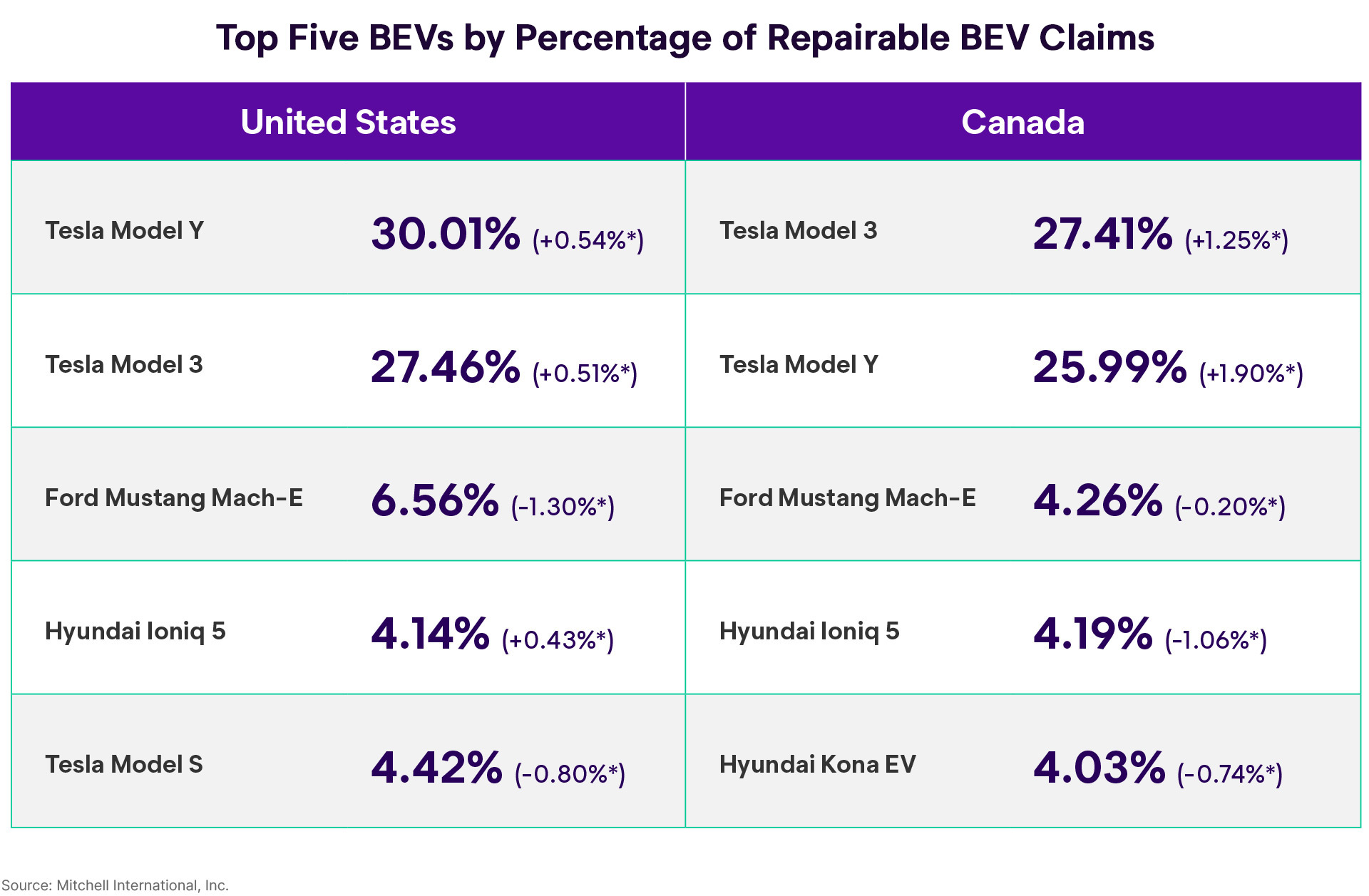

By the Numbers

*Difference between Q2 2025 and Q1 2025.

Subscribe Now

To subscribe to future issues of Mitchell's Plugged-In: EV Collision Insights report, please complete the form below.